8 October 2018

Are you sure you know the difference between a ‘bona-fide’ and a ‘labour-only’ sub-contractor?

For one of them you are required to include under your own Employers’ Liability and Public Liability insurances, for the other you are not. Get it wrong, and it could be rather an expensive mistake. So, how do you differentiate between the two, and which one are you responsible to insure?

Labour-only sub-contractors

‘Labour-only’ sub-contractors will primarily work under your supervision, using materials, equipment, and tools that you provide. Usually, you determine their hours and direct where they work. You may even pay them a salary, or a regular payment that looks like a salary.

In view of this labour only subcontractors are considered to be employees from an insurance perspective and you are required to include them under both your Employers’ Liability and Public Liability insurances.

Bona-fide sub-contractors

‘Bona-fide’ sub-contractors will work without ongoing supervision, set their own hours, are paid by invoice, supply their own tools, equipment, and materials for the works. They will also hold their own insurance policy to cover their work.

In this regard you would not be responsible for covering their Employers’ Liability as they have a legal requirement to insure their own employees.

Whilst you would also not have to cover their Public Liability insurance in the first instance, you would still need to disclose the bona-fide subcontractors activities to your own insurers so that your policy would respond on a contingency basis. The reason for this is in case the bona-fide sub-contractors public liability cover failed and/or had been cancelled. Your insurers would then cover the claim in full.

It is also important to note that there is likely to be a condition under your Public Liability insurance cover that you check your bona-fide sub-contractors have their own Public Liability cover in place with an equal limit of indemnity to your own.

Grey area

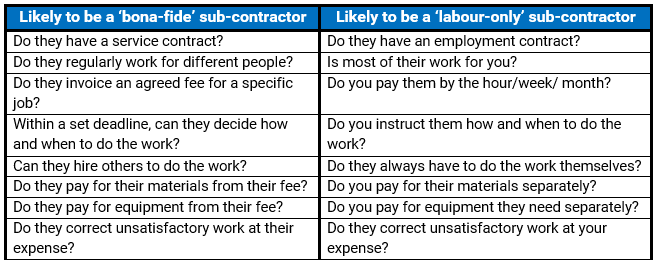

Sometimes the dividing line between the two can be rather grey, so here’s a checklist that may help:

Yvette Payne, Centor’s Commercial Division Manager, comments:

“This can at times be a very grey area. Centor’s expertise can help you make the right choices and protect you from painfully large pay-outs if things go wrong.”

For more information, get in touch with:

Yvette Payne

ycp@centor.co.uk

020 7330 8735