10 April 2017

Flood Re – one year on

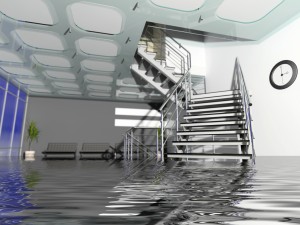

Flood Re is a British world-first, and a major success. It was set up just a year ago – as a combined initiative from the Department for Environment, Food and Rural Affairs and the Association of British Insurers – to make home insurance more affordable in flood-prone areas.

Like all great ideas, it is remarkably simple.

The scheme covers both buildings and contents. If an insurer deems a property to be a high flood risk, it can outsource the flood cover element of the policy to Flood Re, a not-for-profit organisation. The insurer pays Flood Re a premium determined by the property’s Council Tax band – about £210 for building and contents cover for band A homes rising to £1,200 for Band H. Flood Re also offers a policy excess of only £250.

Any flood claims are then paid from the Flood Re pot which is made up of the premiums paid, plus an average £10.50 levy on every home insurance policy sold in the UK.

There are a few exceptions to the scheme such as buy-to-let landlords, commercial premises and homes built since 2009, this latter to discourage developers building on flood plains.

The results have been dramatic.

- When the scheme was launched 16 insurers were signed up. A year later the number has increased to 60, representing 90% of the total home insurance market.

- This has brought much greater choice. Before Flood Re only 9% of homes with a flood claims history could secure quotes from two or more insurers. Now, 95% could obtain two or more quotes, and 84% could get five or more!

- Even more importantly it has created competition. In the past year, four out of five households with a flood claims history have seen the cost of the quotes they are offered more than halve.

As Mark Hoban, Chairman of Flood Re, puts it: “Flood Re has changed the insurance market so that tens of thousands of households that have been flooded can access more affordable insurance.”

Richard Grainger of Centor adds: “Flood Re has been one of the great insurance success stories. We understand the disruption and heartbreak if your home is flooded – an emotion often made even worse by the problems of reinsurance. At Centor we help our clients seek out the insurer who will offer the best value flood insurance for their situation.”

For more information and advice on insuring homes with a high flood risk, call Richard Grainger at Centor on 020 7330 8705.

How the effects of Brexit could leave you underinsured. Why you need to think about how your business manages its data